The complexities of global tax compliance

Global tax regulations under Pillar Two introduce complex challenges. Organizations must manage varying tax rules across different jurisdictions, which can make compliance overwhelming. Ensuring accurate data collection and calculating effective tax rates (ETR) for each jurisdiction adds another layer of difficulty.

Why robust systems are essential

Compliance with Safe Harbour and GloBE regulations requires robust processes and seamless coordination across multinational operations. Handling vast amounts of financial data demands a solution that guarantees data accuracy, reduces compliance costs, and supports strategic decision-making globally.

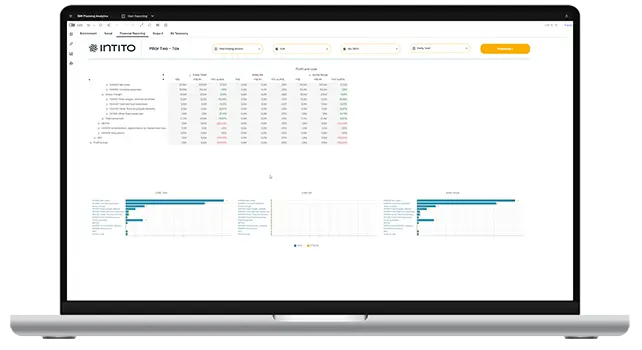

Simplify your global tax reporting with our Pillar Two – Tax solution

Intito’s Pillar Two – Tax solution is designed to streamline global tax compliance. Powered by IBM Planning Analytics, it automates complex tax reporting processes, including Safe Harbour and GloBE calculations. Seamlessly integrated with your consolidation tool, our solution ensures transparency, auditability, and data integrity, helping you stay compliant across all jurisdictions.

Auditability & Transparency

Gain full traceability from data entry to final reports, ensuring a clear audit trail and providing confidence in compliance and decision-making.

Seamless Integration

Our solution integrates seamlessly with IBM Controller, allowing for smooth synchronization of financial data across legal entities and countries.

Automated Compliance

Automate the complex calculations needed for Safe Harbour and GloBE compliance, reducing manual work and minimizing errors.

Data Integrity & Governance

Ensure data accuracy and consistency across your organization, enabling robust reporting and strategic planning.

Scalable & Flexible

As tax regulations evolve, our solution adapts to meet your growing business needs, ensuring your compliance efforts are future-proof.

Effortless Tax Filing

Easily export data in CSV or XML formats for direct tax authority submission. Customize with extensive integration options to fit your needs.

Developed by experts

Intito’s Pillar Two – Tax solution is powered by IBM Planning Analytics, a trusted platform for financial data management. With our solution, you benefit from cutting-edge technology combined with the deep expertise required for tax compliance. IBM Planning Analytics ensures a structured, scalable approach to managing global tax complexities.

Take control of your tax reporting

See how Intito’s Pillar Two solution can transform your tax processes. Schedule a demo today and experience streamlined, accurate reporting firsthand.